Corporate Governance

In 2023, with the expansion of the market share of key products, Gudeng Precision's

operations experienced explosive growth, and the annual revenue grew by 58% to reach a

record high of NT$3.159 billion.

The EPS also increased by nearly 176%, reaching a record high of NT$11.12, and the after-tax net profit was NT$933 million, representing a 177% increase compared to the previous year's after-tax net profit of NT$336 million.

In 2023, Gudeng Precision's highest stock price was NT$344.5, the average stock price was NT$245, and the lowest stock price was NT$167. The earnings per share were NT$11.12, and a cash dividend of NT$8 was distributed to stakeholders, sharing the achievements of revenue with stakeholders.

The EPS also increased by nearly 176%, reaching a record high of NT$11.12, and the after-tax net profit was NT$933 million, representing a 177% increase compared to the previous year's after-tax net profit of NT$336 million.

In 2023, Gudeng Precision's highest stock price was NT$344.5, the average stock price was NT$245, and the lowest stock price was NT$167. The earnings per share were NT$11.12, and a cash dividend of NT$8 was distributed to stakeholders, sharing the achievements of revenue with stakeholders.

Individual financial data from 2020 to 2023

| Item/Year | 2020 | 2021 | 2022 | 2023 | Growth Rate |

|---|---|---|---|---|---|

| Operating Revenue | 1,213,811 | 1,430,164 | 1,994,676 | 3,159,978 | 58% |

| Gross Profit | 602,854 | 600,622 | 941,111 | 1,590,892 | 69% |

| Operating Margin | 160,639 | 24,023 | 338,607 | 724,886 | 114% |

| Net income | 224,155 | 460,312 | 336,660 | 933,071 | 177% |

| EPS (NT$) | 3.25 | 6.18 | 4.03 | 11.12 | 176% |

Unit: thousand NTD dollars

Detailed financial information can be found in Gudeng Precision's financial report:

Economic Value Distributed to Stakeholders

| Item | Details | 2020 | 2021 | 2022 | 2023 | Growth Rate |

|---|---|---|---|---|---|---|

| Economic Value Generated | Operating Revenue | 1,213,811 | 1,430,164 | 1,994,676 | 3,159,978 | 58% |

| Economic Value Distributed | Operating Costs | 610,957 | 829,542 | 1,053,535 | 1,569,086 | 49% |

| Employee Salaries and Benefits | 312,958 | 457,138 | 473,858 | 763,483 | 61% | |

| Payments to Shareholders | 150,616 | 406,630 | 234,715 | 336,998 | 44% | |

| Payments to Governments | 47,767 | 109,045 | 73,854 | 135,156 | 83% | |

| Community Investment | 509 | 1,253 | 5,892 | 5,480 | -7% | |

| Retained Economic Value | 403,962 | 83,694 | 626,680 | 1,113,772 | 78% | |

Unit: thousand NTD dollars

Tax Governance

Gudeng's operations also conform to local legal regulations to ensure the rights and

interests of the company and relevant stakeholders. To effectively control tax risks,

the company follows tax discipline and requires all employees to comply with it,

practicing the spirit of honest operation and striving for sustainable development.

- In accordance with the tax regulations of each country, the company honestly pays taxes and does not use tax havens or other means to evade taxes.

- The company considers tax implications for important business decisions and significant transactions.

- Financial reporting information disclosure follows the relevant legal requirements and is audited by third-party accounting firms.

- Maintaining good interactions with tax authorities to ensure timely communication of tax information and issues.

- Ensuring that Gudeng's financial and tax systems are implemented in accordance with regulatory requirements through internal control mechanisms and risk management.

- Regularly confirming whether local and international tax regulations have been updated to ensure the timely updating of Gudeng's tax system.

Tax Incentives

Gudeng Precision is committed to investing in system upgrades, process innovation

improvements, and accelerating the transformation of its operational model to create a

smart manufacturing green energy factory. Based on Article 10 of Taiwan's "Industrial

Innovation Act", the company applies for a deduction of research and development

expenses within a certain limit from the current year's taxable amount. The total

deduction amount for research and development investment and intelligent machinery in

2023 was approximately NT$25.39 million.

Effective Tax Rate

| Items | 2021年 | 2022年 | 2023年 |

|---|---|---|---|

| Pre-Tax Income | 569,357 | 410,514 | 1,068,227 |

| Income Tax Expense | 109,045 | 73,854 | 135,156 |

| Effective Tax Rate (%) | 19.15% | 17.99% | 12.65% |

| Tax Payments | 24,911 | 133,660 | 160,555 |

| Cash Tax Rate | 4.38% | 32.56% | 15.03% |

Unit: thousand NTD dollars

The Gudeng Precision Board of Directors is the company's highest governing body.

To ensure effective independent supervision and checks and balances, the Board of Directors holds regular meetings to confirm the company's operational direction and financial status, provide professional strategies and guidance to the management team, supervise operational performance, and ensure that the company operates in compliance with the company's articles of incorporation and relevant laws and regulations.

The current term is from July 30, 2021, to July 29, 2023.

To ensure effective independent supervision and checks and balances, the Board of Directors holds regular meetings to confirm the company's operational direction and financial status, provide professional strategies and guidance to the management team, supervise operational performance, and ensure that the company operates in compliance with the company's articles of incorporation and relevant laws and regulations.

The current term is from July 30, 2021, to July 29, 2023.

- In 2023, the Board of Directors held a total of 8 meetings with a 100% attendance rate of all directors.

- In response to the rapid expansion of the group's operations, additional independent directors have been appointed to strengthen the decision-making capabilities for diversified development, and this has been approved at the shareholders' meeting.

Diversified Backgrounds and Core Competencies

In 2013, Gudeng Precision passed the "Corporate Governance Guidelines", requiring board

members to have expertise in various areas, including operational judgment, accounting

and financial analysis, management, crisis handling, industry knowledge, international

market perspectives, leadership, and decision-making abilities. In recent years, due to

the company's development strategy and changes in internal and external environments,

the focus has also been on green energy and environmental protection industry

experiences to achieve the goal of balanced governance. To become a global leader in

semiconductor key materials, Chairman Ming-Chien Chiu and Director Tien-Jui Lin have

refined mold and CNC injection technologies, which not only contribute to technological

innovation in existing business areas but also facilitate the development of new

aerospace businesses. In pursuit of achieving 100% renewable energy usage under the

RE100 initiative, the company has formulated energy resource management strategies and

leverages the international market perspective of Independent Director Chia-Hung Chin

and the experience in the green energy industry from Director Chih-Fang Wei.

Board Independence and Gender and Age Statistics

Currently, there are 8 directors on the Board of Directors, including 4 independent

directors, accounting for 50% of the members. All members are aged above 50, with 29%

being executive directors and 71% being non-executive directors. Chairman Chiu

Ming-Chien serves as the CEO, and Vice Chairman Lin Tien-Jui serves as the General

Manager. The current male-to-female ratio is 100%. To achieve diversified development in

corporate governance, the consideration of appointing female directors has been

carefully evaluated, and it is expected that female directors will be nominated and

appointed at the 2024 shareholders' meeting.

In response to the rapid expansion of the group's operations and the diverse range of

issues to be addressed, Independent Director Qin Chia-Hung was appointed at the 2023

shareholders' meeting to enhance the independence of board decision-making and promote

sound practices in company management and governance.

Performance and Compensation System

To enhance transparency in corporate governance information, the company plans to

establish a reasonable ratio of director-to-employee salaries to share operational

achievements. The remuneration of the board members will be disclosed independently

in the page 21th of the annual report for 2022.

Introduction of members

board business cases

performance and rewards

Internal Performance Evaluation

In 2023, there were no violations of laws or regulations in the social and

economic fields, nor were there any related anti-competition, anti-trust, or monopolistic

behaviors.

Internal and External Complaints :

Mail : GDaudit@gudeng.com

Phone Number: 02-2268-9141 Ext. 1116

Mail : GDaudit@gudeng.com

Phone Number: 02-2268-9141 Ext. 1116

Compliance

Gudeng Precision's directors, managers, and employees all adhere to and are aware of the Code of

Conduct, Article 4 of which states, "The Company shall comply with the Company Act, Securities

Exchange Act, Commercial Accounting Act, Political Donations Act, Anti-Corruption Act,

Government Procurement Act, Public Officials Conflict of Interest Avoidance Act, and other laws

and regulations related to business operations, as the basic premise of practicing integrity in

business". In addition, an audit office is established under the Board of Directors as a

dedicated unit, with sufficient resources and competent personnel, to establish an internal

control system according to the guidelines and rules for processing, updating the guidelines and

responsibilities for formulating and supervising the implementation of the policy of integrity

management and prevention programs, including the scope of laws and regulations such as the

Company Act and the Securities Exchange Act.

Zero Tolerance for Corruption

Through annual internal control self-assessment, Gudeng requires all factories, departments, and

subsidiaries to conduct self-inspections of their business affairs, including compliance with

the Code of Conduct, RBA Code of Conduct, business ethics, and legal compliance. The company

explicitly prohibits its employees or third parties from providing, promising, requesting, or

accepting illegal political donations, bribery, embezzlement, improper charity donations or

sponsorships, unreasonable gifts, entertainment, or other improper benefits, and establishes

preventive measures and procedures to address such issues. Integrity management courses are also

included in the mandatory training for new employees and are periodically conducted to inform

and educate employees, managers, and directors about the relevant regulations to enhance their

understanding of integrity and self-discipline.

Educational Training and Advocacy

Gudeng Precision regularly invites internal and external lecturers to conduct educational

training and advocacy for employees, managers, directors, and substantial controllers to fully

understand the company's commitment to integrity management, policies, preventive measures, and

consequences of violating integrity.

| Course Topics | Number of Courses | Number of Participants | Course Hours |

|---|---|---|---|

| Confidentiality Advocacy | 3 | 1011 | 898 |

| Information Security Management System and Information Security Awareness | 8 | 1064 | 1773 |

| TIPS Management Implications, Company Management Philosophy, Business Ethics, and Other Topics | 10 | 362 | 206 |

Share information at monthly company meetings

Risk Management Organizational

Operation:

In June 2023, Gudeng Precision established the Risk Management Committee, with the Board

of Directors as the highest governance unit. The CEO serves as the chief executive in

charge of risk management. The general manager, operation manager, and first-line

supervisors serve as the frontline risk management personnel. They conduct various risk

detection, identification, assessment, and formulate related countermeasures. They

regularly review and supervise operational meetings, and establish relevant response

teams for different risks and events, assigning responsible supervisors to coordinate

responses. In terms of the internal control system, the audit unit is responsible for

auditing and implementing all risk assessments, and the results are regularly reported

to the Audit Committee and the Board of Directors by the corporate governance

supervisor.

To integrate risk culture into daily operations, the company proactively educates and trains employees to understand risk management, focusing on major risk items (information security, trade secrets) through digital learning courses. The CIO and Legal Counsel conduct advocacy during monthly meetings.

To integrate risk culture into daily operations, the company proactively educates and trains employees to understand risk management, focusing on major risk items (information security, trade secrets) through digital learning courses. The CIO and Legal Counsel conduct advocacy during monthly meetings.

- On November 6, 2020, the Board of Directors approved the addition of the "Risk Management Policy".

- On August 5, 2022, the "Risk Management Policy" was revised and approved by the Board of Directors to align with international trends and practice sustainable development.

- On December 21, 2022, the Board of Directors conducted the annual "Risk Management Plan Operation Report" to address risk identification and operational status.

- On June 23, 2022, the Risk Management Committee was established to promote the Group's Business Continuity Management (BCM) for continuous operation.

- In 2023, the "Operations Continuity and Risk Management Task Force" was established.

Become a Vendor Valued by Customers for Speed and Security Achieve a

Traceable and Complete IT System

As a significant supplier in the global semiconductor industry, Gudeng Precision formulates

rigorous information security policies to protect company assets, research achievements, trade

secrets, compliance with laws and regulations, and contractual requirements, as well as

addressing the concerns and expectations of stakeholders. The goal is to ensure the protection

of company assets and critical information with confidentiality, integrity, and availability.

The Information Security Management Committee was established in October 2021 to ensure that Gudeng Precision compliance with confidentiality, integrity, and availability requirements for company data, protecting customer information from leakage, and preventing business interruptions as a top commitment to its customers.

2023 Achievements:

- Obtained ISO 27001 Information Security Management System certification

- Upgraded the AD server and Exchange server, established VPN multi-factor authentication to prevent confidential data leakage, and made enterprise forms mobile, maintaining flexibility and efficiency

- Promoted the 2023 hardware service upgrade plan, investing 30 million to build ICT infrastructure and a hyper-converged infrastructure, enhancing information security defense network

- Implemented production and manufacturing auxiliary subsystems to enhance production efficiency and quality

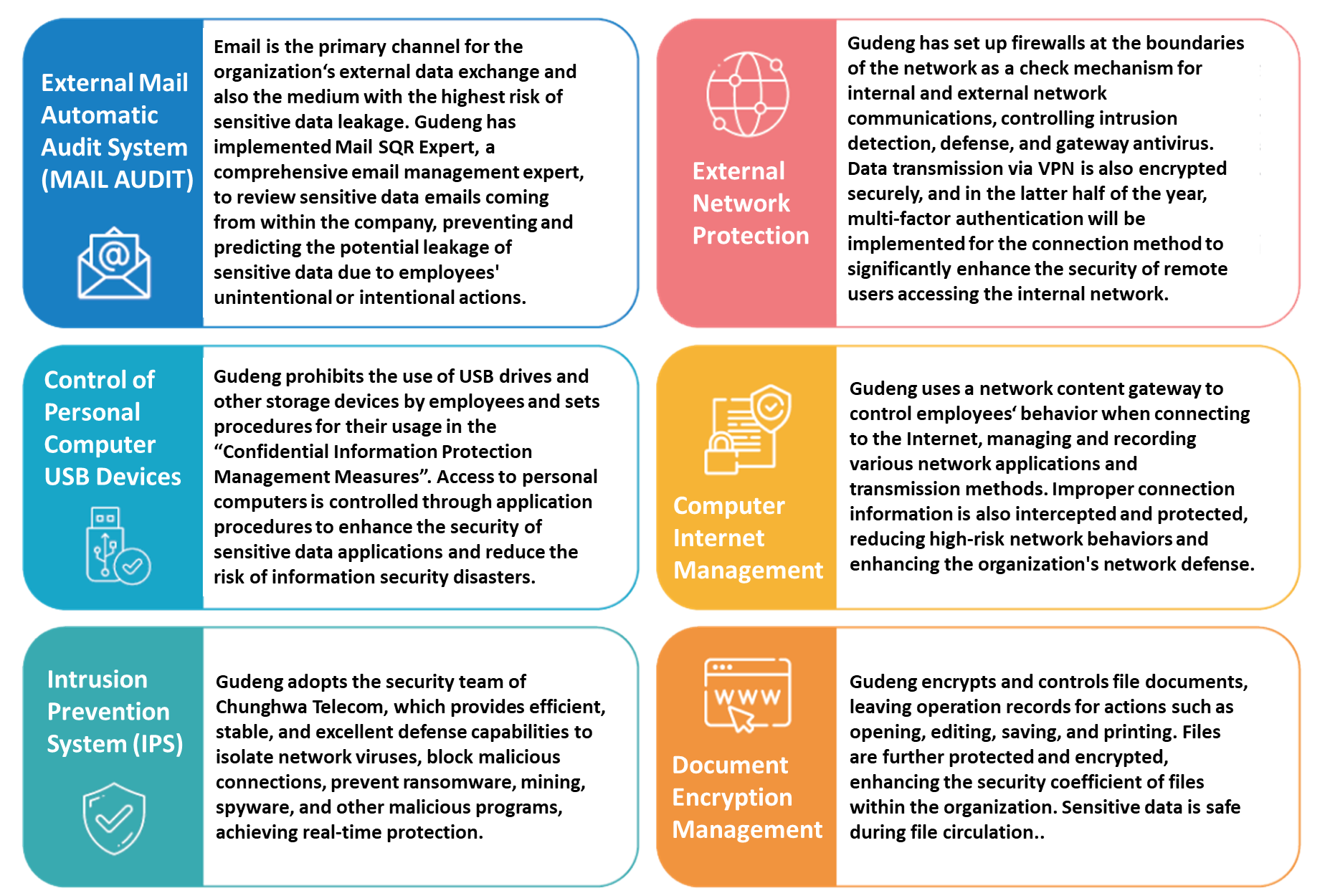

Utilizing internal networks and firewalls to construct an information security system